Apa itu Options Trading?

Apa itu Options Trading?Apasih sebenarnya options trading itu? Yuk mulai pelajari disini!

Learn More Terminologi Umum Options Trading

Terminologi Umum Options TradingOptions trading berkisar pada beberapa istilah fundamental yang membentuk instrumen keuangan ini. Yuk cari tahu disini!

Learn More Cara Trading Options di Pluang

Cara Trading Options di PluangMau mulai trading options tapi belum tahu caranya? Yuk pelajari cara trading options di aplikasi Pluang disini!

Learn More Options vs Spot

Options vs SpotApasih bedanya trading spot dan trading options? Manakah yang lebih menarik? Yuk pelajari perbedaannya disini!

Learn More Options vs Futures

Options vs FuturesKalau sebelumnya kamu sudah belajar tentang bedanya options dengan spot, pelajari disini untuk tahu perbedaan antara options dengan futures!

Learn More Long Call dan Long Put Options

Long Call dan Long Put OptionsLong call dan long put options adalah salah satu cara trading options paling basic. Yuk pelajari disini untuk tahu gimana caranya!

Learn More Elemen Harga Options

Elemen Harga OptionsPilihan kontrak options ada banyak dan beda-beda harganya. Apa aja sih yang mempengaruhi perbedaan harganya? Yuk cari tahu disini!

Learn More Options Greeks

Options GreeksOptions punya indikator yang dinamakan The Greeks. Apasih The Greeks itu? Yuk pelajari disini!

Learn More Exercise dan Assignment

Exercise dan AssignmentApa yang terjadi kalau kontrak options dieksekusi. Pelajari exercise dan assignment disini!

Learn More Manajemen Risiko Options

Manajemen Risiko OptionsOptions trading sama seperti instrumen investasi lainnya punya risiko. Pelajari lebih lanjut disini untuk tahu bagaimana cara menangani risiko trading options!

Learn More Strategi Options Trading

Strategi Options TradingMungkin kamu bingung harus pakai strategi apa untuk trading options. Yuk pelajari disini untuk belajar tentang strategi-strategi dasar trading options!

Learn More Apa itu Short Options?

Apa itu Short Options?Short options atau selling/writing options adalah posisi dimana trader menjual kontrak options untuk mendapatkan premium di awal. Selengkapnya bisa kamu pelajari di sini!

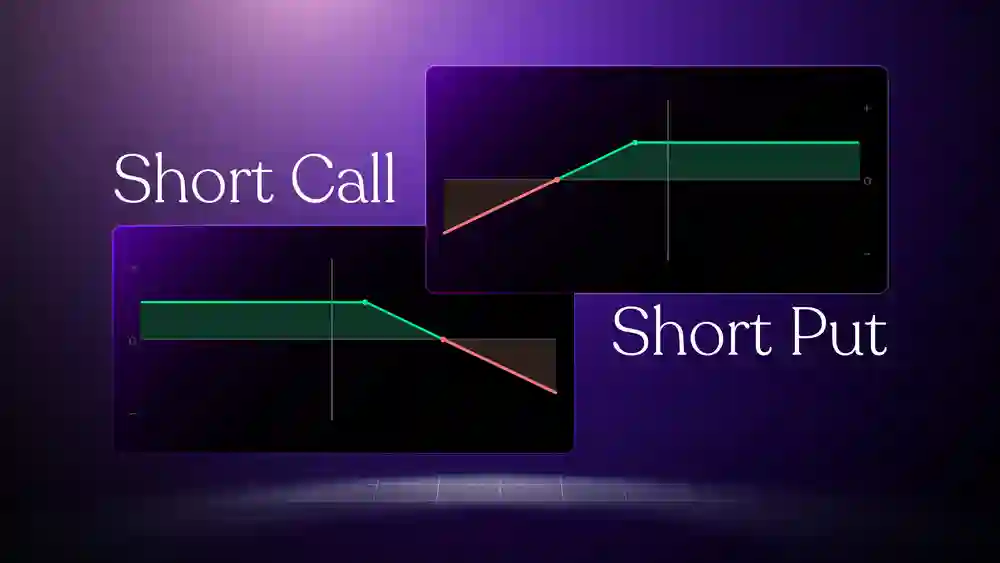

Learn More Short Call dan Short Put Options

Short Call dan Short Put OptionsShort call options adalah menjual kontrak options yang memberikan pembeli hak untuk membeli saham pada harga tertentu, sedangkan short put adalah menjual kontrak yang memberikan pembeli hak untuk menjuak saham pada harga tertentu. Selengkapnya bisa kamu baca di sini!

Learn More Risiko Short Options

Risiko Short OptionsSeperti instrumen investasi lainnya, short options juga memiliki risiko yang perlu kamu ketahui dan pahami. Simak cara memitigasi risko tersebut di sini!

Learn More

Underlying Stocks

- 1 share represents 1 unit

- No leverage

- Never expires

Options

- 1 contract represents 100 shares

- High leverage

- Expires on the designated date

- Yes! You don'/t need to worry because Options Trading in Pluang is based on real US stock market prices.

- Options Trading is facilitated by PT PG Berjangka which is licensed and supervised by OJK for financial derivative products with underlying securities. Transactions are recorded on JFX and KBI. PT PG Berjangka also cooperates with overseas brokers that are licensed and supervised by the SEC and the OCC. Learn more.

- Options Trading is widely adopted, with 84 billion contracts traded worldwide in 2023.