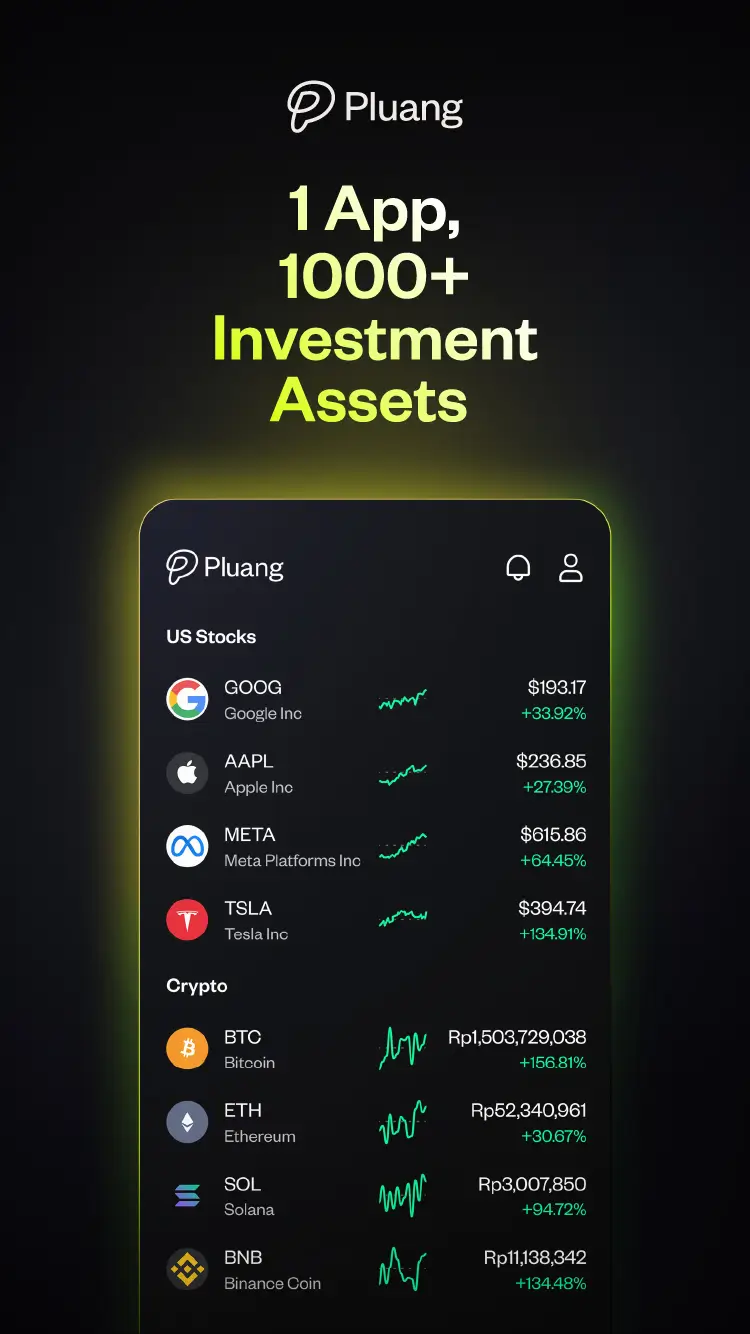

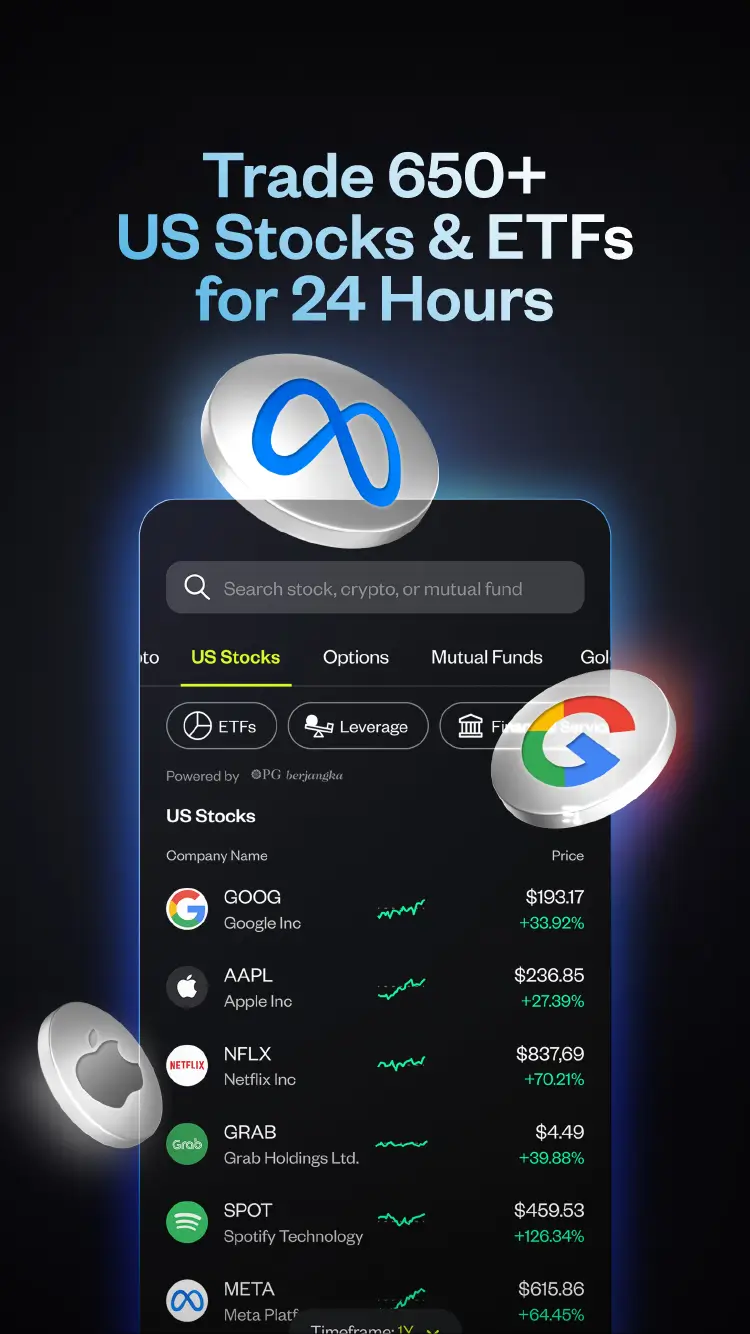

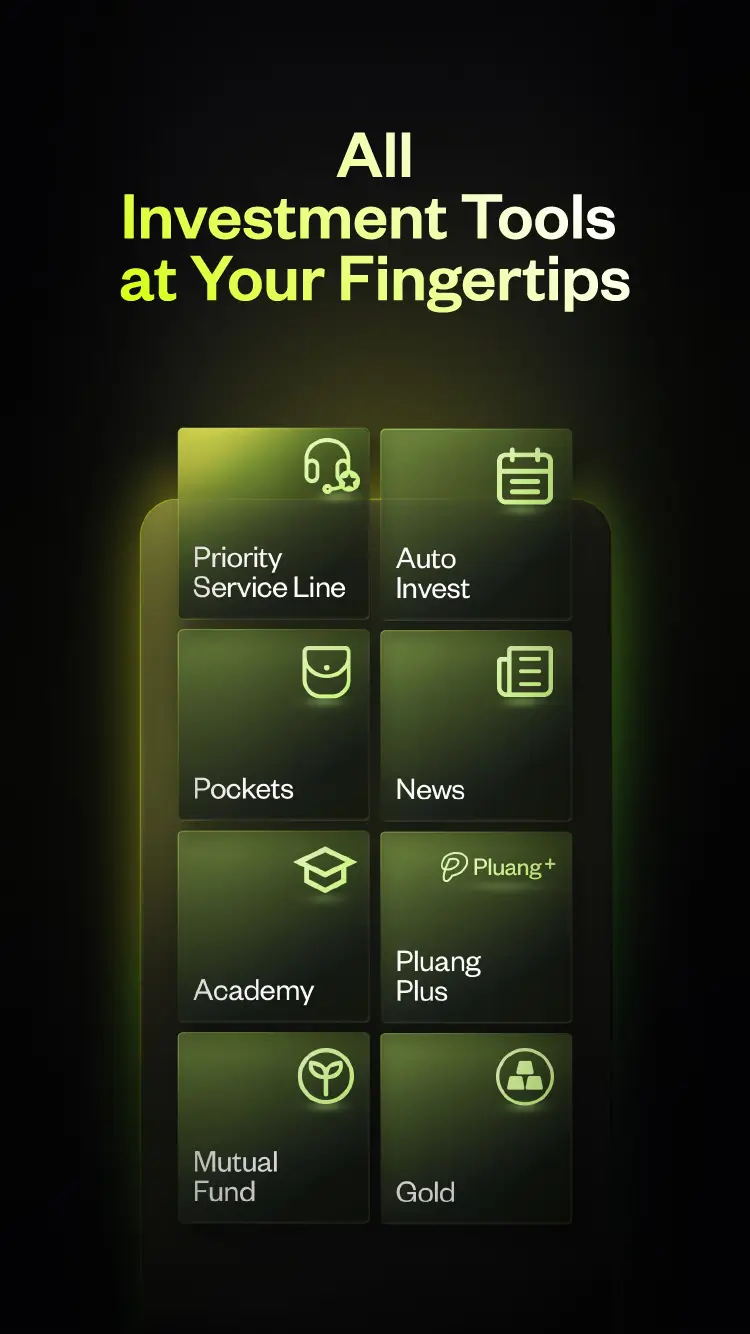

Trade on Pluang

One platform for all markets

Download

Fees

Transparent pricing. All fees related to withdrawals and trades.

Other Fees

Invest with ease—zero account opening fees

Deposit Fee

Depending on the top up method, Pluang may charge an administrative fee.

Top Up Method

Fee

Direct BCA Transfer

Free

Virtual Account

≥ Rp500,000 : FREE

< Rp500,000 : Rp3,000

E-Wallet

1.5%

Note: The fees above are subject to an 11% VAT.

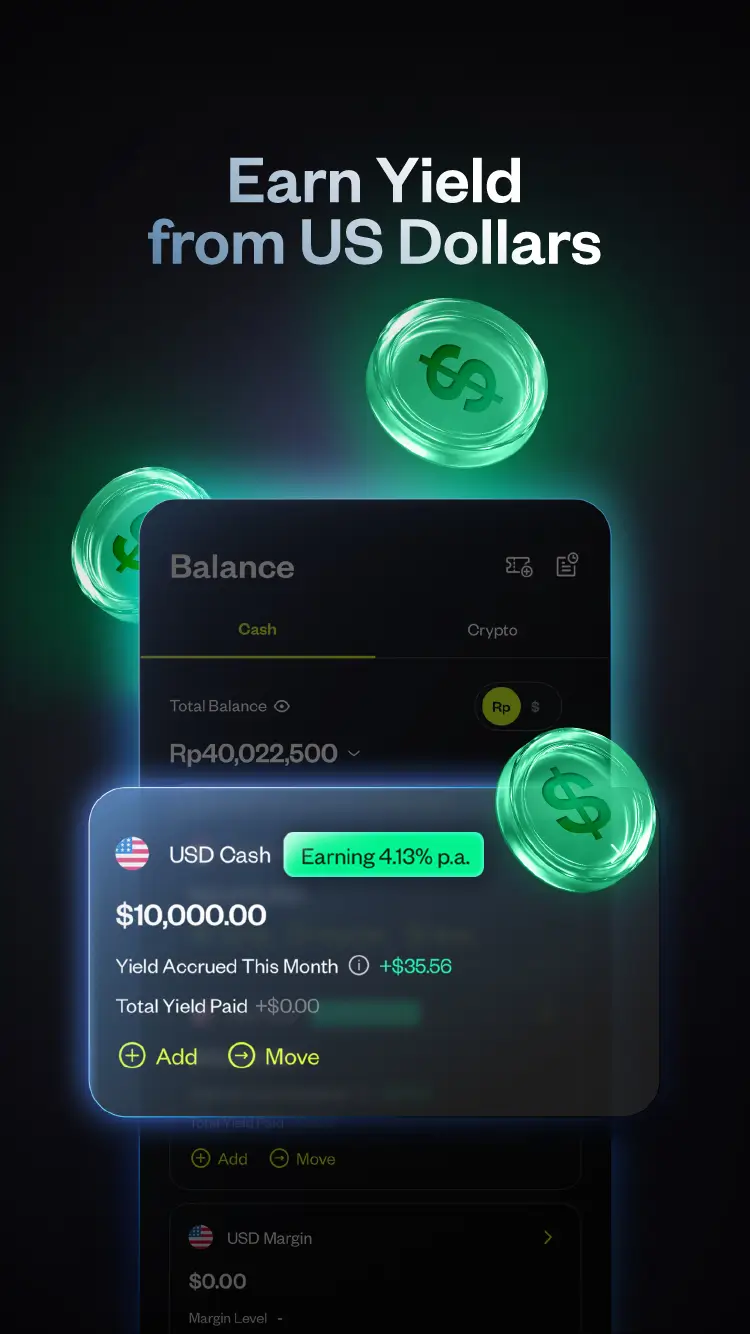

Pluang Plus Members can enjoy USD Direct Deposit by contacting Relationship Managers for seamless transactions without incurring potential losses due to fluctuating forex rates.

Find out more about Pluang Plus

Withdrawal Fee

Transaction (per month/user)

Fee Charged

First transaction

Free

Second transaction and onwards

Rp4,500 per transaction

Note: The fees above are subject to an 11% VAT.

Foreign Exchange Fees

Pluang’s USD price is determined by custodian banks under the supervision of Bank of Indonesia, in compliance with Bappebti regulations.

Conversions between IDR to USD and vice versa are subject to a 0.25% fee. This fee is subject to an 11% VAT.

There is a market spread based on volatility, volume, and the time of the day. As a rule of thumb, market spread will be the lowest during weekdays from 08:00 to 15:00. This is directly related to the bank’s working hours, as all of the foreign exchange (forex) transactions will be passed onto Pluang’s bank partner.

The spread typically increases when the banks are closed. This is mainly due to the fact that Indonesia’s local banks do the majority of the forex transactions, and there is very little liquidity when the banks are closed. Due to this, the spread will typically increase in anticipation of the overnight price movements.

See example