Digital Gold, Crypto, and Mutual Funds

Product

Tax Rate

Digital Gold

All capital gains from the sale of digital gold on the Pluang application are subject to taxation, and are the individual’s responsibility to report.

Crypto Assets

Tax is charged on every buy and sell transaction on Pluang.

The following effective tax rate is charged on the transaction value of the Crypto Assets:

Buy transaction: No tax applied*

Sell transaction: 0.21% Withholding Tax**

*Based on PMK 50/2025.

**Tax rate is based on Income Tax Law Article 22.

Mutual Funds

0%

Mutual Funds are investment products under financial assets that are not subject to tax on investment profits. Article 4 Paragraph 3 of the Income Tax Law explains that Mutual Funds or participation unit holders are not considered taxable (objek pajak).

US Stocks, USD Yield, Options, and Crypto Futures

Realized gains from US Stocks, Options, and Crypto Futures transactions, along with interest earned on USD Yield, are taxable under income tax (Pajak Penghasilan or PPh) Article 17 (Pasal 17). Pluang users can report their taxes in accordance with applicable tax regulations.

Dividends that have been subject to a 15% withholding tax in the country of origin are reported as part of the user’s additional income in their tax reporting, in accordance with applicable tax regulations.

US Stock Options and Crypto Futures are also subject to a 12% VAT* (Pajak Pertambahan Nilai or PPN), applied to Pluang transaction fees, Jakarta Futures Exchange (JFX) fees, and Central Finansial X (CFX) fees. Please note that there is no VAT on US Stock transactions or USD Yield.

Calculating Article 17 Tax Rate

Individual Taxpayer Rate

Tier

Annual Income

Tax (PPh)

I

0–Rp60M

5%

II

> Rp60–250M

15%

III

> Rp250–500M

25%

IV

> Rp500M–5B

30%

V

> Rp5B

35%

Based on the provisions of Article 17, we can calculate the tax amount that must be paid by the taxpayer.

Example (1)

If a taxpayer has a taxable income of Rp60,000,000 p.a. from annual salary and Rp10,000,000 p.a. from USD Cash Yield. The calculation would be as follows:

= Rp70,000,000

Rp60,000,000 x 5%

= Rp3,000,000Rp10,000,000 x 15%

= Rp1,500,000Rp3,000,000 + Rp1,500,000

= Rp4,500,000Example (2)

If a taxpayer has a taxable income of Rp200,000,000 p.a. from annual salary and Rp100,000,000 p.a. from USD Cash Yield. The calculation would be as follows:

= Rp300,000,000

Rp60,000,000 x 5%

= Rp3,000,000(Rp250.000.000 - Rp60,000,000) x 15%

= Rp28.500.000(Rp300.000.000 - Rp250.000.000) x 25%

= Rp12.500.000Rp3,000,000 + Rp28.500.000 + Rp12.500.000

= Rp44.000.000How to request tax report from Pluang

You can request your tax report based on your transaction history for the corresponding tax year by following the instructions provided below:

Open your Account Page, then tap “Tax Reports” or “Laporan Pajak”.

Choose the specific “Tax Year“ and “Asset Class“, then tap “Send to Email“.

Your tax report will be sent to your registered email.

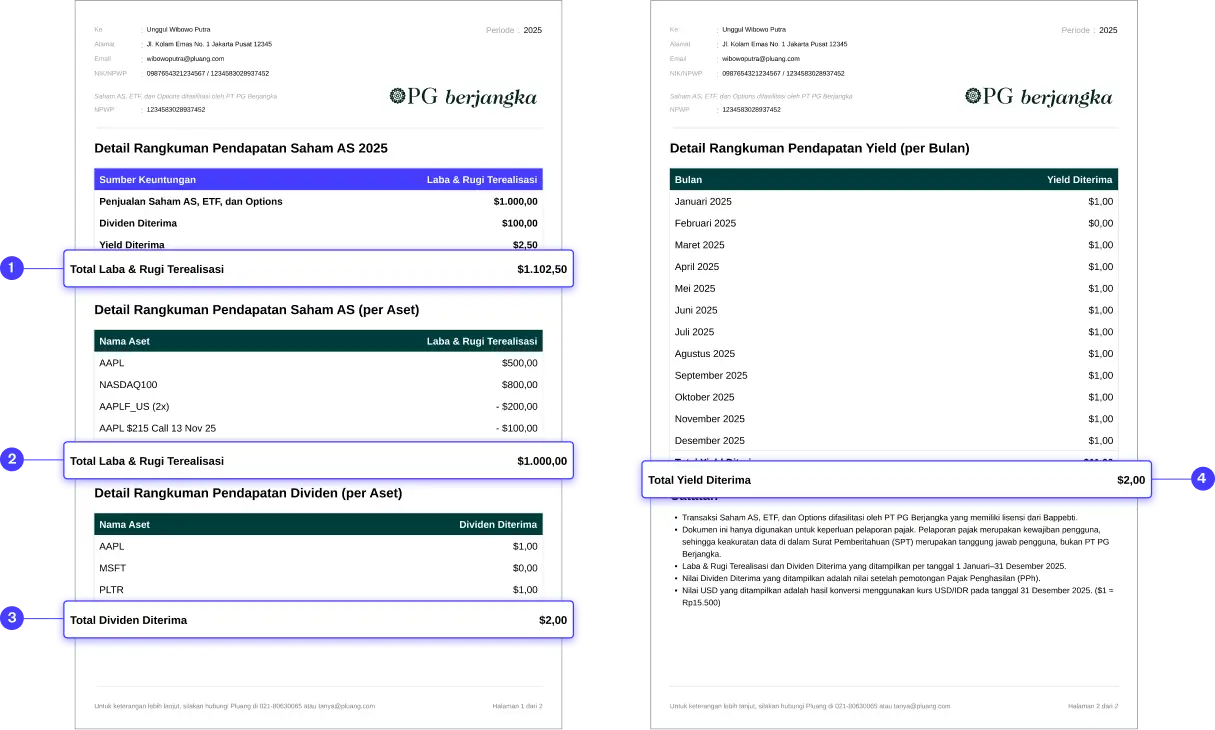

What is inside your tax report from Pluang?

- 1

Summary of Your Total Gains / Losses on the corresponding tax year.

- 2

Your Total Gains / Losses from US Stocks on the corresponding tax year.

- 3

Your Total Dividend Earned on the corresponding tax year.

- 4

Your Total Yield Earned from USD Cash Yield on the corresponding tax year.