Pluang Plus FAQ

GENERAL INFORMATION

How to become a Pluang Plus Member?

You can increase your Net Investment Value to a minimum of Rp100,000,000,-.

After your transaction is successful, your Pluang Plus account will be upgraded automatically within 1x24 hours.

What is Total Investment Capital?

Total Investment Capital is the total of all funds you put into Pluang (Top-Up and/or Crypto Asset transfers) including realized profits (profits you have realized after selling assets, if any) minus the total cash-out (withdrawal to bank account) and crypto send/transfer you have made.

Once the required amount is met, you will automatically become a Pluang Plus Member without any additional fees. Here are several scenarios to understand the total investment capital requirements:

What is the benefit for becoming a Pluang Plus Member?

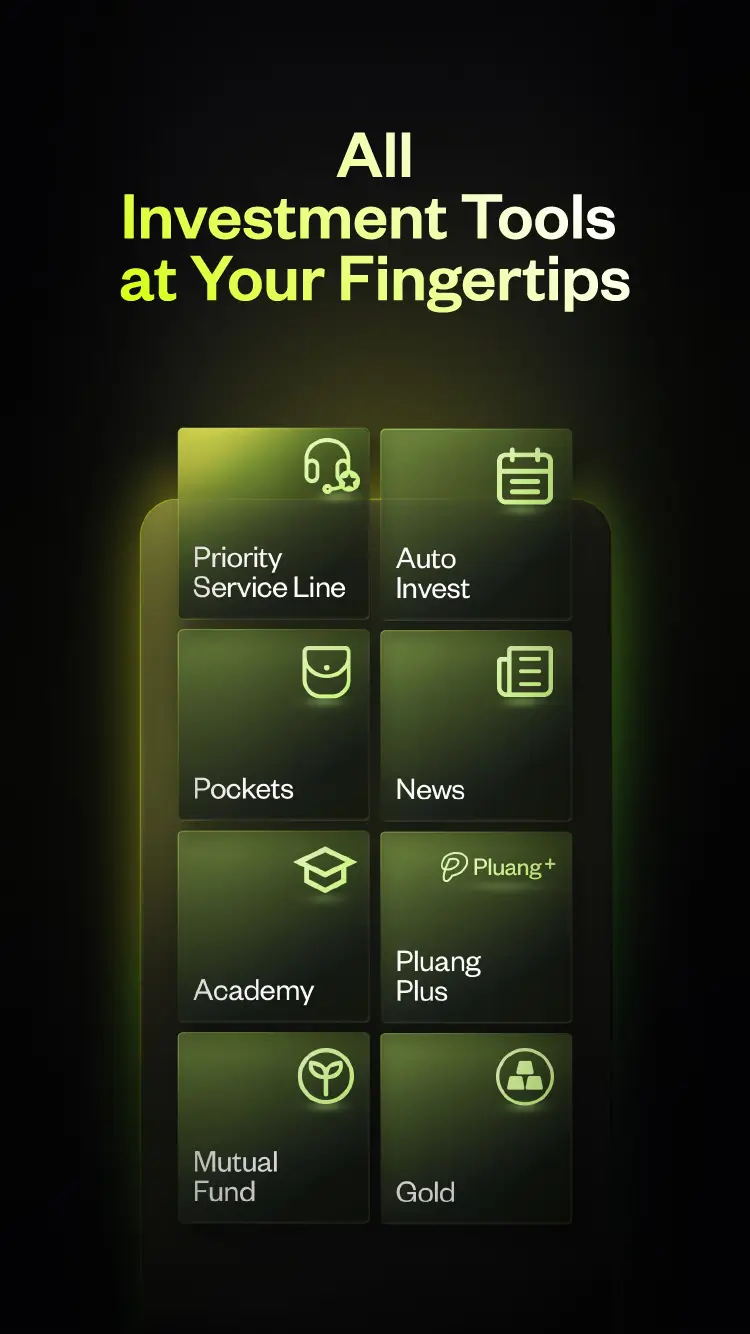

- Priority Service Line: Experience direct service handled by the Priority Services Line with guaranteed express response within 5 minutes (only via Live Chat).

The Priority Line is also available on email tanya@pluang.com with 15 minutes response time. For direct response, please call Pluang Hotline (021) 8063 0065 (available Monday–Friday, 09.00–18.00 WIB) - OTC Forex: Get access to Over-the-Counter Foreign Exchange (OTC FX) for USD and IDR with competitive exchange rates and no transaction fees.

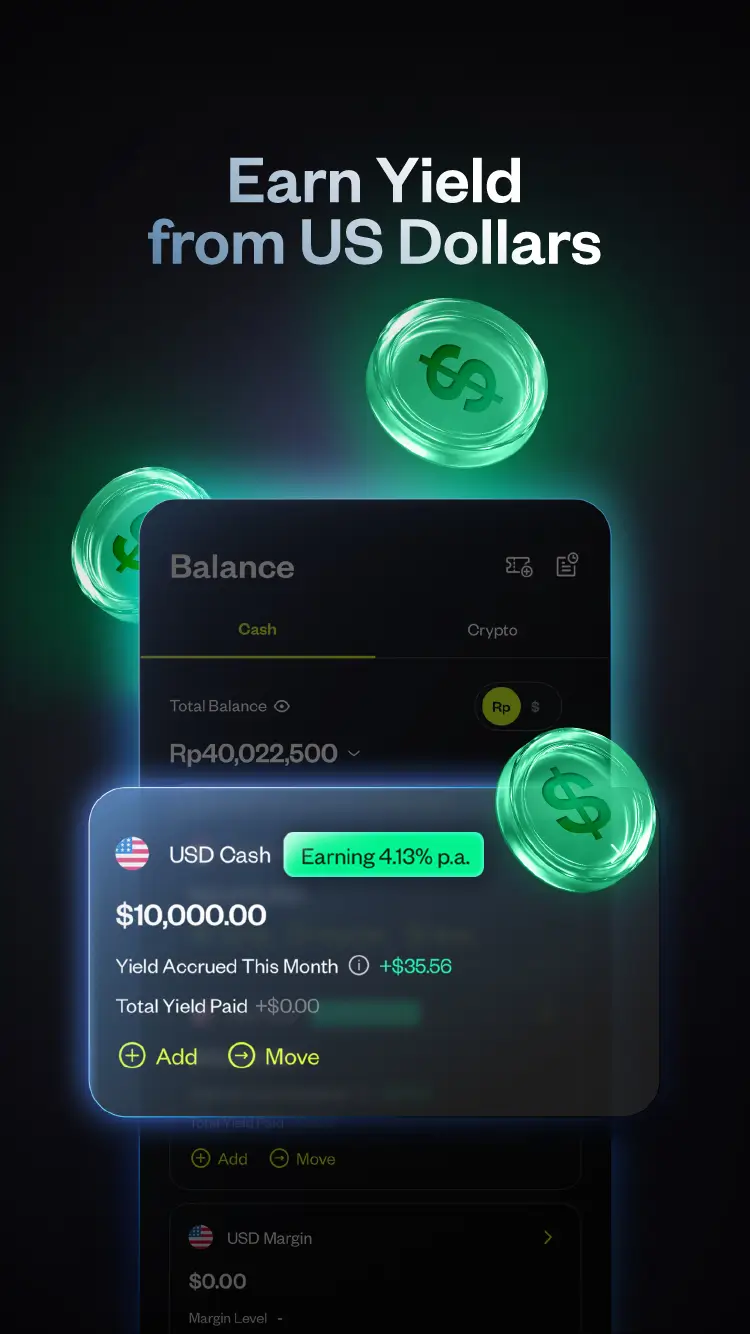

- USD Direct Deposit & Withdrawal: Enjoy the ease of topping up and withdrawing USD directly from your USD account hassle-free without worrying about losing the value of your money due to foreign exchange rate differences.

- Higher Yield: Earn up to 3.38%* Yield p.a. for idle USD balances

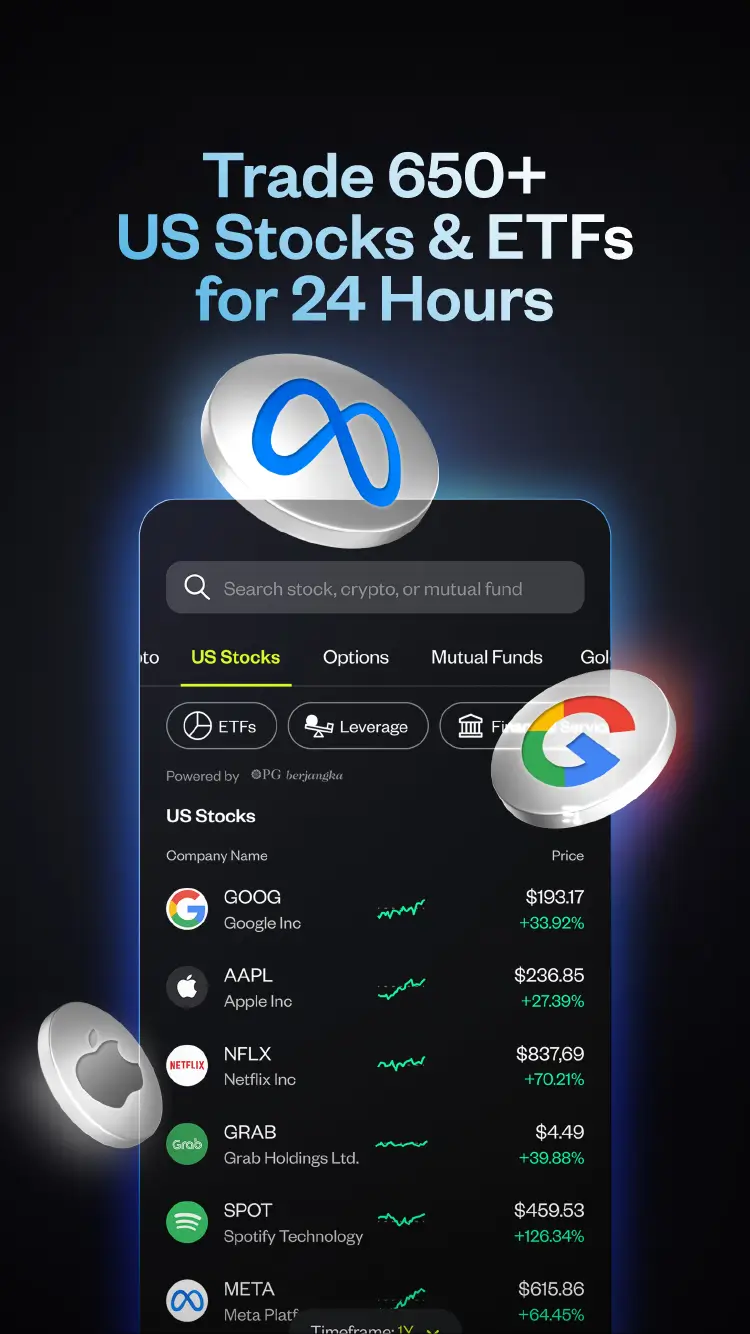

- Lower US Stock Trading Fees: 0.2% US Stock Transaction Fees.

- Lower Overnight Rate with Leverage Feature: 0.0125% Leveraged Daily Interest Rate.

- Exclusive Webinar: Join the exclusive webinars to gain comprehensive insights on trading tips, tricks, and latest market updates. Regularly check your email & Pluang app for webinar invitations.

- Traders Gathering: Connect in person with traders and financial experts at the Traders Gathering. Frequently check your email & Pluang app for gathering invitations.

- The Forum: An in-person forum for product & feature consultations, market updates and networking for Pluang Plus members. Regularly check your email & Pluang app for The Forum invitations.

*) rate could possibly change depends on US interest rate

FEATURES, PRODUCTS AND SERVICES

How to make a Direct USD Deposit?

You can use the Direct USD Deposit service without losing the value of money due to a minimum foreign exchange difference of US$10,000 by contacting Pluang Hotline (021) 8063 0065 (available Monday–Friday, 09.00––18.00 WIB) and email tanya@pluang.com

How to use OTC FX?

You can utilize OTC FX services to enjoy competitive exchange rates and free transaction fees for min US$20,000 exchange value.

For further information please contact +62-811-8112-5998 (only for WhatsApp chat)

How to use Limit Order?

Limit Order is a type of Advanced Orders feature options that youcan use when trading Crypto Assets and US Stocks. Limit Order allows you to specify the maximum price you are willing to pay for a buy order or the minimum price you are willing to accept for a sell order. Learn more about Limit Orders on the Limit Order page.

Apart from using Limit Order, you can also maximize your trading and investment strategies by using other Advanced Orders features such as Stop Orders and Stop-Limit Orders.

- Stop Order: Used for instant order execution once price reaches the specific level. You can use Stop Order to manage risk (e.g. stop loss) or to take profit by setting a Stop Sell Order, or getting into a position through a Stop Buy Order.

You can read more information about the Advanced Order Feature on this page

What is Traders Club?

Traders Club is an exclusive community specifically designed as a two-way sharing forum for Pluang Plus Members. You will have the opportunity to receive the latest information on market signals and movements, as well as participate in webinars, offline gatherings and other exclusive events available only to Pluang Plus Members.

Information regarding Traders Club activities will be communicated via the WhatsApp channel and the email registered in Pluang.

QUESTIONS & HELP

Why can’t I contact my RM?

Pluang no longer has an individual RM. To serve you better, we provide 2 extra services you can enjoy as Pluang Plus Members:

- Priority Services Line where you, as Pluang Plus Members, get fast-track Customer Service with a maximum 5 minutes response time via Live Chat. Our Priority Service team will assist and cater to all your questions or complaints about Pluang Plus.

- Traders Club where you get exclusive access towards market insights and most updated signals given by experienced traders from various credible investment communities.

Where should I call/text if there are any further questions about Pluang Plus?

If you have questions or concern regarding Pluang Plus membership program, contact us at (021) 8063 0065 or email tanya@pluang.com.

All questions or complaints will be assisted and catered by Priority Services Line (guarantee express 5 minutes response via Live Chat)

DATA SECURITY & INVESTMENT FUNDS

Is my investment safe at Pluang?

Your investment in Pluang is safe because our platform is registered and supervised by BAPPEBTI or OJK which acts as the regulator of financial services and the economic sector in Indonesia. Pluang has strong cybersecurity and double protection for your sensitive information.

We adhere to the government regulations and customer funds are guaranteed to be safe because the customer fund account (RDN) is separated from operational funds.

- Mutual Fund investments in Pluang are managed directly by an investment manager and the funds will be held by a custodian bank licensed by the OJK. In addition, the custodian bank is responsible for supervising the fund manager in managing investor investment funds that have been deposited. This means your money will remain safe in the event where Pluang ceases operations

- We place 70% of customer Crypto Asset funds in cold wallets (crypto storage devices that offer a high level of security because they are not connected to the internet) so that they are not controlled/interfered with by institutions/government as recommended by applicable government regulations.

- We are required to have private insurance to avoid the risk of being hacked or in the event of bankruptcy.

To provide excellent service, Pluang collaborates with entities that already have licenses from financial services regulators and the economic sector in Indonesia.

- Pluang Emas, supported by PT Pluang Emas Sejahtera, is licensed and supervised by BAPPEBTI

- US Stocks & ETF supported by PT PG Berjangka are licensed and supervised by BAPPEBTI.

- Pluang collaborates with PT PG Berjangka, a Futures Broker with PALN permission from CoFTRA, offering shares traded on NASDAQ and NYSE

- Crypto assets supported by PT Bumi Santosa Cemerlang are registered with BAPPEBTI.

- Pluang Mutual Funds supported by PT Sarana Santosa Sejati (Pluang Grow) has a license as a Mutual Fund Securities Selling Agent (APERD) and is supervised by the OJK.

What happens if Pluang goes bankrupt?

In the case of bankruptcy, customer funds will be under the control of the Regulator and the Clearing House/Custodian Bank which is also directly supervised by the regulator, so that the process of disbursing customer funds will be carried out and supervised by the regulator (OJK/BAPPEBTI) and KBI/Custodian Bank. The regulator will guarantee that customers can withdraw funds according to the amount of assets they own.

Pluang always collaborates with legal, official and licensed entities where every governing permit has been regulated, supervised and in accordance with applicable laws.

Thus, all funds from customers must be reported and stored in a separate account guaranteed by Kliring Berjangka Indonesia (KBI), as well as placed in a special custodian bank for Mutual Fund products.