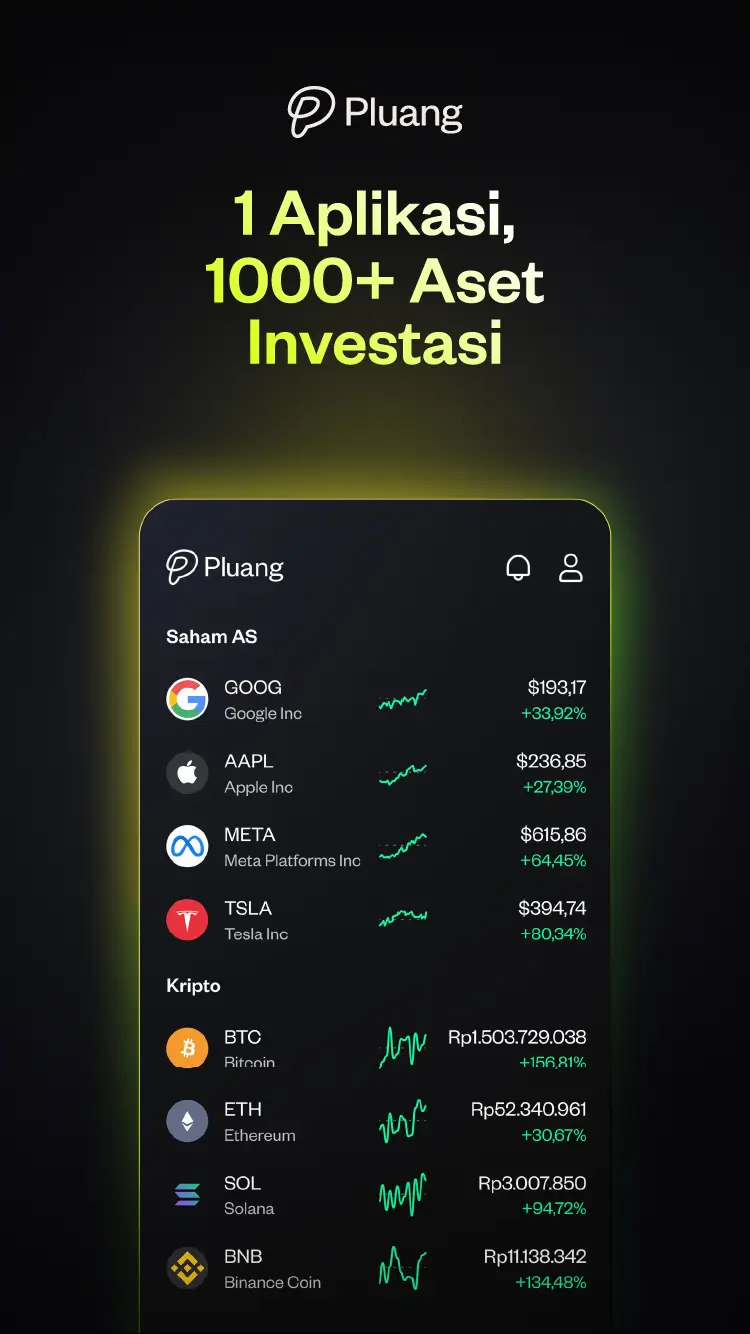

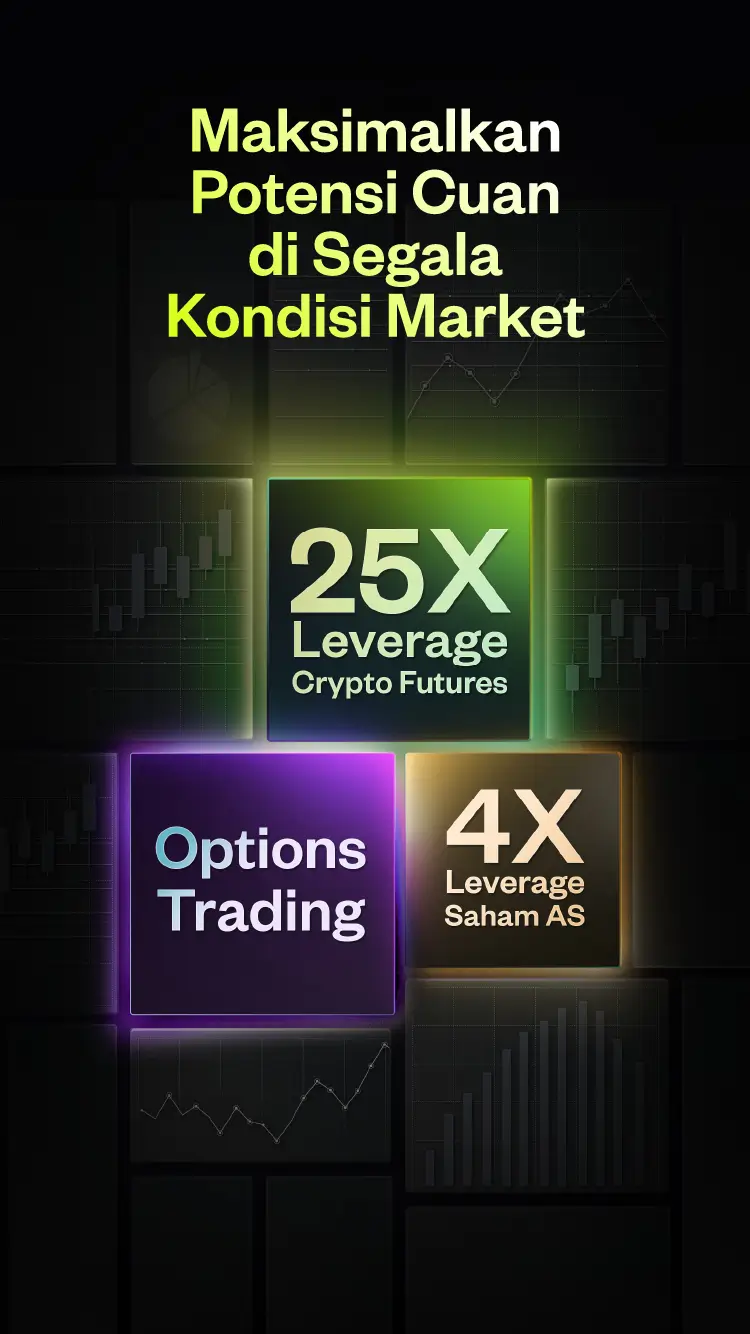

Trading di Pluang

Satu platform untuk semua pasar

Download

Kenapa investasi reksa dana di Pluang?

Modal Rendah

Investasi cukup dengan modal Rp100.000.

Portofolio Seimbang

Dapatkan keuntungan dari beragam portofolio kelolaan manajer investasi tepercaya.

Likuiditas Tinggi

Reksa Dana dapat dibeli dan dijual setiap hari kerja kapan saja.

Eksplor Reksa Dana

| Nama | AUM | Harga | Perubahan (1 Bulan) | |

| 15,3696T | Rp1.888,00 | +0,29% | ||

| 205,486M | Rp1.966,03 | +0,26% | ||

| 104,969M | Rp1.865,88 | +0,26% | ||

| 696,72M | Rp2.571,94 | +0,23% | ||

| 4,44T | Rp1.160,17 | +0,32% | ||

| 76,2449M | Rp1.198,59 | +0,31% | ||

| 20,19M | Rp1.752,43 | +0,22% | ||

| 867,16M | Rp1.651,05 | +0,40% | ||

| 3,75M | Rp1.367,21 | +0,22% | ||

| 7,66T | Rp1.466,88 | +0,36% |

| Nama | Harga |

| Rp1.888,00+0,29% | |

| Rp1.966,03+0,26% | |

| Rp1.865,88+0,26% | |

| Rp2.571,94+0,23% | |

| Rp1.160,17+0,32% | |

| Rp1.198,59+0,31% | |

| Rp1.752,43+0,22% | |

| Rp1.651,05+0,40% | |

| Rp1.367,21+0,22% | |

| Rp1.466,88+0,36% |

Bandingkan Reksa Dana

Syailendra Dana KasRp100.000/unit | BNI-AM Makara InvestasiRp100.000/unit |

|---|---|

| Keuntungan Bulanan0,37% * | -0,67% * |

| Asset Under Management3.46T | 188B |

| Tingkat RisikoLow | Moderate |

| Manajer InvestasiPT Syailendra Capital | PT BNI Asset Management |

| Bank KustodianBank CIMB Niaga | CIMB |

| Min. PembelianRp100.000 | Rp100.000 |

| Alokasi Aset Kas & Deposito32,47% Obligasi67,53% | Kas & Deposito3% Obligasi97% |

Keuntungan Bulanan

Asset Under Management

Tingkat Risiko

Manajer Investasi

Bank Kustodian

Min. Pembelian

Alokasi Aset

Syailendra Dana KasRp100.000/unit

0,37% *

3.46T

Low

PT Syailendra Capital

Bank CIMB Niaga

Rp100.000

Kas & Deposito

32,47%

Obligasi

67,53%

BNI-AM Makara InvestasiRp100.000/unit

-0,67% *

188B

Moderate

PT BNI Asset Management

CIMB

Rp100.000

Kas & Deposito

3%

Obligasi

97%

Dipercaya 11 Juta+ Pengguna

FAQ

Investasi Reksa Dana Aman dan Berlisensi

Reksa Dana difasilitasi oleh PT Sarana Santosa Sejati yang berizin dan diawasi OJK.

Pelajari lebih lanjut